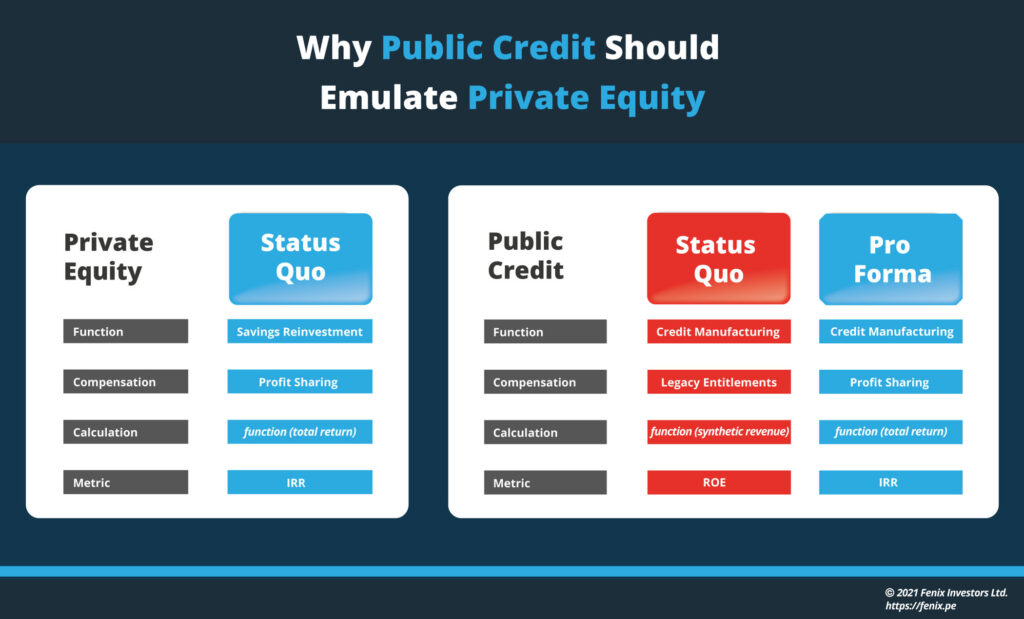

Why Public Credit Should Emulate Private Equity

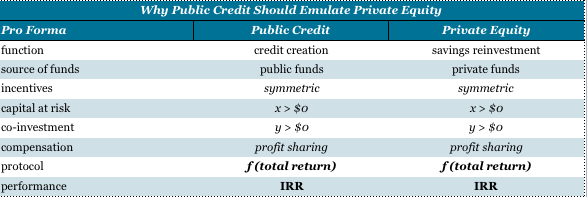

In the status quo, public credit compensates based on synthetic revenue rather than total return. In the pro forma, public credit emulates private equity: public credit restructures compensation into a system of profit sharing, and profit sharing is a function of total return.

This compensation restructuring solves microeconomic objectives and macroeconomic objectives:

- Microeconomic objective: The pro forma eliminates the systematic underpricing of risk, thereby inoculating primary dealers against insolvency. This compensation restructuring manages the mutability of solvency: while entitlements are a function of synthetic revenue, profit sharing is a function of total return, and the symmetric nature of profit sharing increases the probability of solvency.

- Macroeconomic objective: The pro forma reduces the capital losses created in the manufacturing of credit. This compensation restructuring eliminates the primary causal factor for the capital losses created in the manufacturing of the money supply, and this compensation restructuring provides the solution to obviate banking crises. These capital losses currently have a public cost given the decision to monetize the capital losses. This monetization of capital losses is a dilution of the money supply.

Microeconomic Objective: Managing the Mutability of Solvency

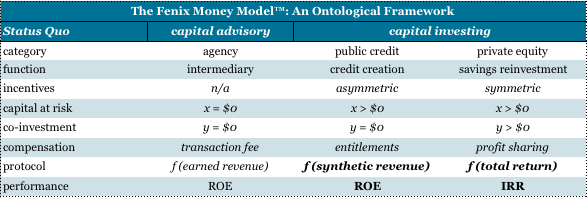

The Fenix Money Model™ provides the ontological framework* for analysis: the Fenix Money Model™ (i) establishes the semantic distinction between credit creation and savings reinvestment and (ii) demonstrates why credit creation should emulate savings reinvestment.

Specifically, the Fenix Money Model™ demonstrates why public credit should emulate private equity: public credit should restructure compensation into a system of profit sharing based on total return, and this compensation restructuring will reduce the capital losses created in the manufacturing of credit.

* Note: Words are semantic units that convey meaning, and language shapes perception.

Public Credit: The Status Quo

In the status quo, public credit compensates based on entitlements, and entitlements are a function of synthetic revenue (e.g. origination fees, acquisition fees, spread income). However, synthetic revenue should not be analyzed as a return on capital. Until principal repayment, synthetic revenue should be analyzed as a return of capital rather than as a return on capital.

Entitlements are a system of asymmetric incentives; however, asymmetric incentives create divergent outcomes, and asymmetric incentives have negative implications for solvency. Entitlements represent a codified conflict of interest, and this conflict of interest provides permission to raid the principal through capital losses and high expenses.

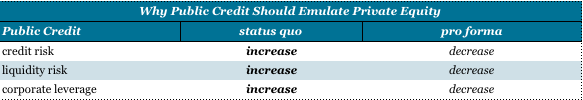

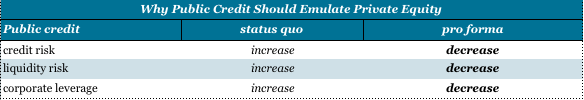

With entitlements, public credit systematically underprice risk. With entitlements, public credit are incentivized to increase synthetic revenue; consequently, primary dealers pursue the following strategies:

- Increase credit risk: Primary dealers focus on high-yield rather than total return without considering whether the high-yield originates from a large coupon or a discounted price.

- Manufacture liquidity risk: Primary dealers increase the duration mismatch despite a primary reliance on short-duration liabilities. (Note: Assuming an upward sloping yield curve).

- Increase corporate leverage: Primary dealers increase ROE by increasing corporate leverage. The decrease in shareholders’ equity reduces the necessary buffer against negative price volatility.

Public Credit: Pro Forma

In the pro forma, public credit restructures compensation to emulate private equity: public credit compensates based on profit sharing, and profit sharing is a function of total return. Since symmetric incentives create convergent outcomes, the pro forma increases the probability of solvency.

With profit sharing, this compensation restructuring will manage the mutability of solvency, and this compensation restructuring will inoculate primary dealers against insolvency. With profit sharing, primary dealers will eliminate the systematic underpricing of risk, since primary dealers will emphasize the following:

- Primary dealers will be incentivized to focus on total return, and total return is primarily a function of purchase price. This focus on purchase price creates an explicit incentive to protect the principal.

- Primary dealers will be measured by total return, and total return is quantified by IRR. Total return is measured by the capital account: the capital account represents a comprehensive measure of performance, incorporating income transactions and capital transactions.

- Primary dealers will reduce corporate leverage and operating leverage by moving compensation costs from fixed costs to variable costs.

With profit sharing, public credit will be incentivized to focus on total return; consequently, primary dealers will pursue the following strategies:

- Decrease credit risk: Primary dealers will focus on purchase price, and this is the primary determinant of capital returns and the primary method to manage capital risk. In credit investing, the focus on purchase price is imperative given the negative skew of the return distribution.

- Decrease liquidity risk: Primary dealers will reduce the maturity mismatch. Duration can be a source of liquidity, and duration can be a use of liquidity. While a duration mismatch is an operating risk of commercial lending, primary dealers are susceptible to insolvency when discount rates rise: if long duration, the market values of short-term liabilities and long-term assets will change at different rates. Specifically, the values of long-term assets will decrease at a faster rate than the values of short-term liabilities, and this increase in discount rates will have a negative impact on the equity account.

Decrease corporate leverage: Primary dealers will reduce the use of corporate leverage. The increase in shareholders’ equity will provide a necessary buffer against negative price volatility.

Macroeconomic Objective: Reducing Capital Losses in the Manufacturing of Credit

“When a loan is made by the commercial bank, the bank is keeping only a fraction of central bank money as reserves and the money supply expands by the size of the loan. This process is called ‘deposit multiplication’.”

In the pro forma, public credit emulates private equity: this compensation restructuring reduces the capital losses created in the manufacturing of credit. This compensation restructuring preserves the integrity of the money supply, and this compensation restructuring is the solution to obviate banking crises.

The capital losses of primary dealers have a public cost: the monetization of capital losses is a dilution of the money supply, and the monetization of capital losses has long-term negative consequences:

- Monetization is a symptomatic solution that eliminates the negative feedback loop of bankruptcy, and negative feedback loops are an essential component of self-regulating systems.

- Monetization prevents the increase in discount rates, and an increase in discount rates is necessary to increase the rate of savings.