Primary Dealers Should Emulate Private Equity

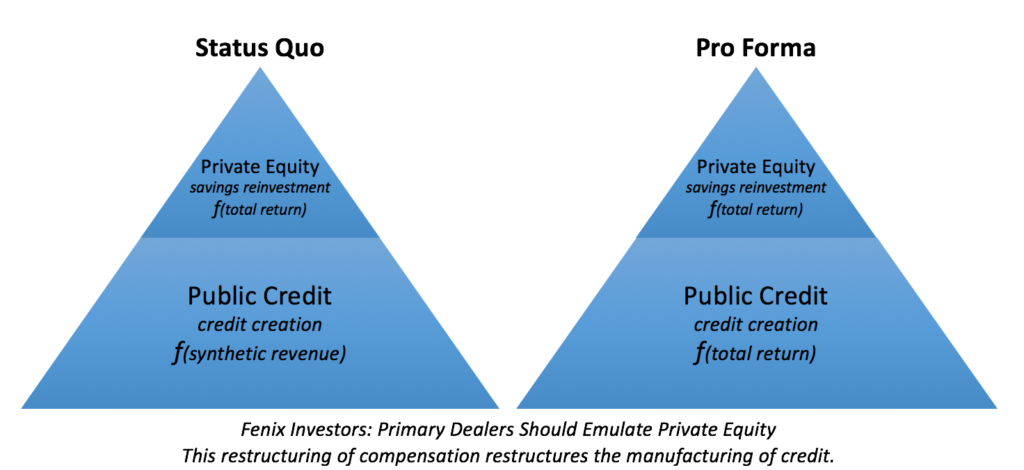

The solution to banking crises is to have primary dealers emulate private equity: this restructuring of compensation restructures the manufacturing of credit. Specifically, this restructuring of compensation

- reduces the capital losses created in the manufacturing of credit, and

- inoculates primary dealers against insolvency.

Primary Dealers: The Status Quo

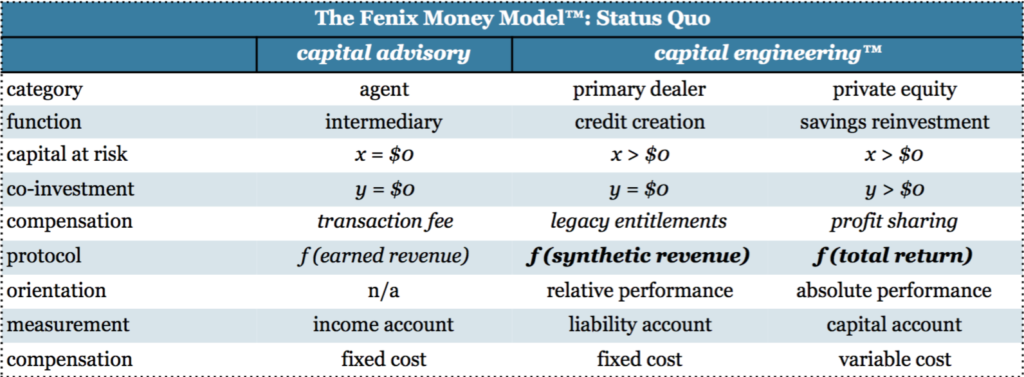

In the status quo, primary dealers are compensated based on a system of asymmetric incentives (i.e. legacy entitlements), and legacy entitlements are a function of synthetic revenue (e.g. origination fees, acquisition fees, spread income). However, legacy entitlements represent a codified conflict of interest, and this conflict of interest provides explicit permission to raid the principal.

With legacy entitlements, primary dealers systematically underprice risk. Until principal repayment, synthetic revenue should be analyzed as a return of capital rather than as a return on capital.

The Fenix Money Model™: An Ontological Framework

The Fenix Money Model™ establishes the functional distinction between credit creation and savings reinvestment. The Fenix Money Model™ provides the ontological framework for analysis: words are semantic units that convey meaning, and language shapes perception.

Primary Dealers: The Pro Forma

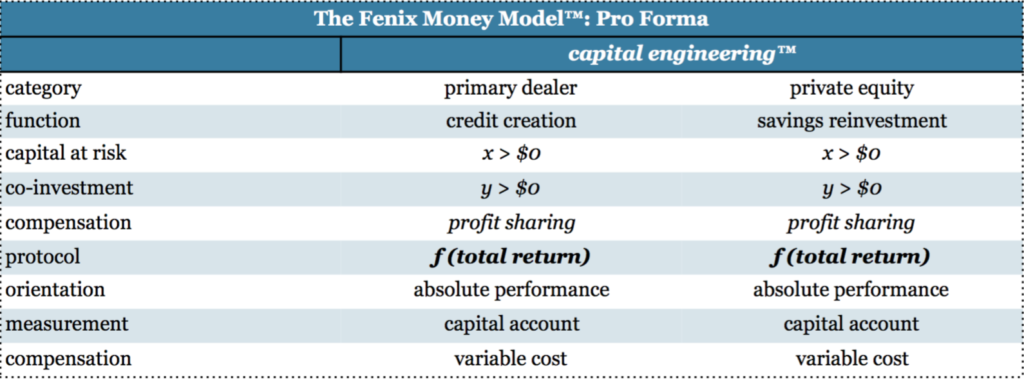

With the Fenix Money Model™, the pro forma becomes self-evident: primary dealers should restructure compensation to emulate private equity. While legacy entitlements are a function of synthetic revenue, profit sharing is a function of total return.

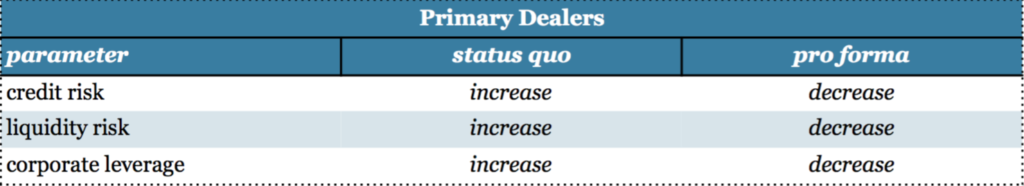

For primary dealers, this restructuring of compensation shifts compensation from legacy entitlements to profit sharing, and the resulting focus on profit sharing provides the following benefits:

- Primary dealers will be incentivized to focus on total return, and total return is primarily a function of purchase price. This focus on purchase price creates an explicit incentive to protect the principal.

- Primary dealers’ performance will be measured by the capital account. Profit sharing is a function of total return, and total return is measured by the capital account. The capital account represents a comprehensive measure of performance, incorporating income transactions and capital transactions.

- Primary dealers’ compensation costs will shift from fixed costs to variable costs, reducing the operating leverage of the business.

Objective 1: Reducing Capital Losses Created in the Manufacturing of Credit

“When a loan is made by the commercial bank, the bank is keeping only a fraction of central bank money as reserves and the money supply expands by the size of the loan. This process is called ‘deposit multiplication’.”

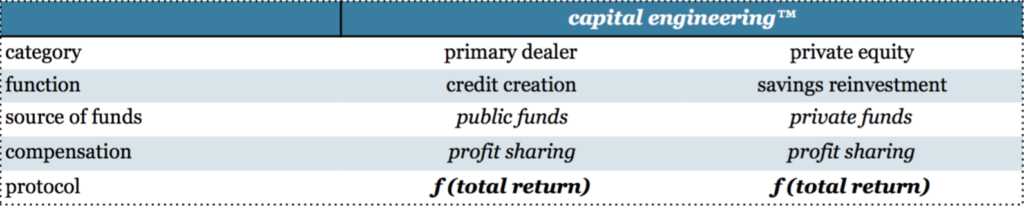

With profit sharing, public funds will emulate private funds: this restructuring of compensation is the primary solution to reducing capital losses created in the manufacturing of credit.

With legacy entitlements, primary dealers systematically underprice risk. In the status quo, primary dealers are compensated based on a system of asymmetric incentives (i.e. legacy entitlements), and this system of asymmetric incentives is the primary causal factor for the capital losses created in the manufacturing of money supply.

Given the political decision to monetize, primary dealers’ capital losses have a public cost: the monetization of capital losses is a dilution of the money supply.

Objective 2: Providing the Primary Inoculation Against Insolvency

With profit sharing, primary dealers will manage the mutability of solvency: this restructuring of compensation is the primary solution to inoculate primary dealers against insolvency.

Status Quo: In the status quo, primary dealers are compensated based on a system of asymmetric incentives (i.e. legacy entitlements). Since asymmetric incentives create divergent outcomes, this system of asymmetric incentives increases the probability of insolvency.

With legacy entitlements, primary dealers are incentivized to increase synthetic revenue; consequently, primary dealers pursue the following strategies:

- Increase credit risk: Primary dealers focus on high-yield rather than total return without considering whether the high-yield originates from a large coupon or a discounted price.

- Manufacture liquidity risk: Primary dealers increase the duration mismatch despite a primary reliance on short-duration liabilities. (Note: Assuming an upward sloping yield curve).

- Increase portfolio leverage: Primary dealers increase portfolio leverage. The decrease in shareholders’ equity reduces the necessary buffer against negative price volatility.

Pro Forma: In the pro forma, primary dealers will be compensated based on a system of symmetric incentives (i.e. total return). Since symmetric incentives create convergent outcomes, the pro forma increases the probability of solvency.

With profit sharing, primary dealers will be incentivized to focus on total return; consequently, primary dealers will pursue the following strategies:

- Decrease credit risk: Primary dealers will focus on purchase price, the primary determinant of capital returns and the primary method to manage capital risk. In credit investing, the focus on purchase price is especially imperative given the negative skew of the return distribution.

- Decrease liquidity risk: Primary dealers will reduce the duration mismatch. While a duration mismatch is an operating risk of commercial lending, duration can be a source of liquidity, and duration can be a use of liquidity. If long duration, primary dealers are susceptible to insolvency when discount rates rise: the market values of short-term liabilities and long-term assets change at different rates.

- Decrease portfolio leverage: Primary dealers will reduce the use of portfolio leverage. The increase in shareholders’ equity will provide a necessary buffer against negative price volatility.