Excerpts: Restructuring Watchlist: EFH Moves Off, In Largest Default

- Energy Futures received S&P’s speculative-grade default rate in November, 2009, and was downgraded to SD on account of a distressed exchange. All this came in the wake of the $45B LBO of TXU, engineered by KKR, TPG, and GS — the largest LBO deal in history was essentially a bet that natural gas prices would increase.

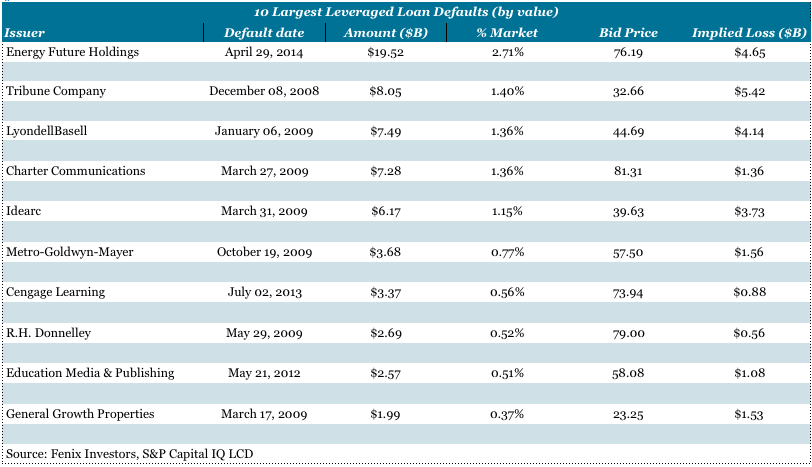

- It goes without saying that Energy Future Holdings’ bankruptcy created the loan market’s largest-ever default by both amount and percent. In absolute terms, in fact, EFH’s $19.5 billion of loans – the largest single institutional loan on record – is more than twice that of Tribune, the previous record holder, at $8.05 billion.

- But because EFH traded higher on the day of its default than Tribune did on the date of its default – at 76.19, versus 32.66 for Tribune, according to Markit – it actually created a lower implied credit loss on the default date, at $4.65 billion, versus $5.42 billion for Tribune.

Source: HighYieldBond.com