An Introduction to Distressed Value

[T]he leverage that talent can provide is lessened as a company matures, John Sheldon suggests. While partnerships, by definition, are shaped in the images of the partners ‘and end theoretically when the partners die, a corporation never ends.’ Come hell, high water, or hostile takeover, a corporation is obliged to endure for the benefit of others — namely its stockholders.

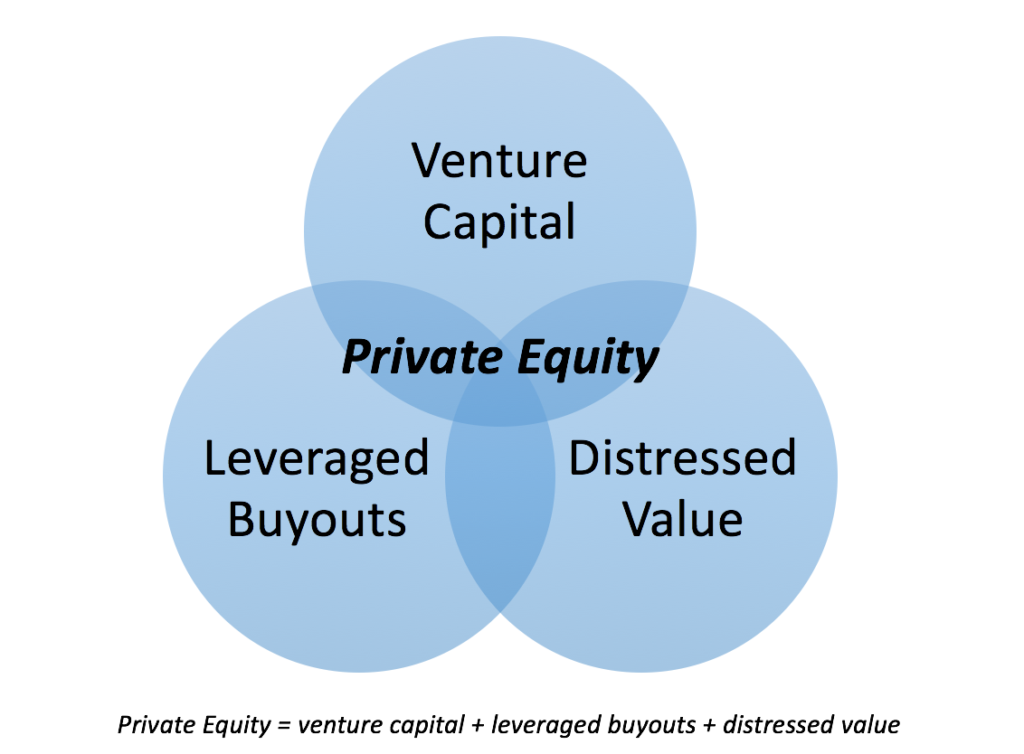

Private equity is the business of ownership, and private equity investors create value across a company’s lifecycle. In private equity, investors who specialize in distressed value practice a form of deep value investing, often with an event-driven element. Affectionately known as “vulture investing,” distress investing is a fundamentally contrarian strategy, and the practice demonstrates that the best cure for low prices is low prices.

Distress investing began to be recognized as a distinct investment style in the late 1980s/early 1990s. In this period, distress investors found success by purchasing distressed assets from the Resolution Trust Corporation, an entity created subsequent to the collapse of Drexel Burnham Lambert and the the burgeoning high-yield debt markets.

Distress investing is conventionally associated with distressed debt, including credit instruments trading at a substantial discount to par. Distressed debt is usually defined as (i) debt trading with a yield to maturity of 1000+ basis points more than the comparable treasury security or (ii) debt trading below 80 cents on the dollar. However, the distressed debt universe also includes defaulted credit instruments, below-par bank loans, stressed performing bonds, “busted” convertibles, NPL portfolios, and post-restructuring equity.

Traditionally, distress investing is a secondary market strategy where credit instruments are transferred from par buyers to distress investors. In distressed debt, the best returns are typically created in the period following the peak in defaults. Thus, buyers must be active prior to the bottom of the market, and this transfer of credit instruments from par buyers to distress investors creates a “J-curve” effect.

Drivers of Distressed Opportunities

Private equity investors find distressed opportunities across the market cycle: distressed opportunities are driven by macro developments and idiosyncratic factors. While the relative importance varies over time, these drivers manifest in some combination in each market cycle.

Macro: The Credit Cycle

The bank loan (e.g. leveraged loans) and high-yield bond markets have been the primary sources of distressed opportunities, and easy credit drove distressed opportunities in the 1990s and the 2000s. The peak levels of low-rated bond issuance in 1998 ($31.0 billion) and 2007 ($53.6 billion) were followed by peak levels of defaulted debt in 2002 and 2008.

While distressed value is fundamentally contrarian, distress investors benefit from a degree of market correlation. Distress investors tend to generate their best returns in strong markets: capital returns tend to improve as greater liquidity and higher valuations result in the tightening of corporate spreads.

Micro: Idiosyncratic factors

Idiosyncratic factors also drive distressed opportunities, and these idiosyncratic factors can impact countries, industries and companies. Idiosyncratic factors can include natural disasters, political crises, changes in the competitive landscape, technological obsolescence, and unsuccessful operating plans.

Every point in the market cycle offers distressed opportunities; however, many misperceive that distressed opportunities are only created at points in a market cycle that overlap with a spike in default rates.

The primary idiosyncratic factor that drives distressed opportunities is managerial failures: companies do not intentionally become distressed, and managerial failures are typically the leading cause of distressed value. Managerial failures are demonstrated by (i) an undercapitalized balance sheet and/or (ii) an underperforming cash flow statement.