Why IRR trumps ROE: IRR measures Total Return

As a performance metric, IRR is fundamentally superior to ROE, since IRR is a measure of total return. While IRR is a cash flow metric, ROE is an accounting metric. Further, IRR is more difficult to manipulate than ROE.

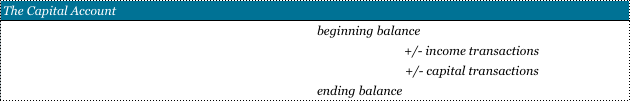

The capital account measures performance

- The capital account provides a comprehensive measure of performance

- Total return is provided by the capital account

- Total return is measured by IRR

IRR is a cash flow metric; ROE is an accounting metric

While IRR is a cash flow metric, ROE is an analytically flawed measure of performance: (i) ROE is an accounting metric, (ii) ROE’s numerator is an income statement measure and (iii) ROE is easier to manipulate.

- ROE is an accounting metric, not a cash flow metric. Specifically, the numerator is an accounting metric, and the denominator is an accounting metric (i.e. net earnings/shareholders’ equity).

- ROE’s numerator is an income statement measure. The income account is a temporary account, while the balance sheet represents permanent accounts. The income statement is a nested statement: revenues and expenses are components of shareholders’ equity, and net income links the income statement to the balance sheet. Net income is not a general ledger account; net income is simply the mathematical difference between revenues and expenses.

- ROE is easier to manipulate than IRR. The ROE formula is decomposed into profit margin, total asset turnover, and leverage factor. Thus, ROE is easily increased by creating leverage at the portfolio level.

(profit margin) * (asset velocity) * (leverage factor)

(net earnings/revenues) * (revenues/total assets) * (total assets/equity)

IRR and ROI: Two Measures of Total Return

Return on investment (ROI) provides a measure of total return, since it is calculated as total return/capital invested. However, internal rate of return (IRR) is the preferred measure of total return, since IRR incorporates the time value of money.

Specifically, IRR expresses return as a function of time. Intuitively, IRR is the effective compounded interest rate; IRR is a more complex version of CAGR, and IRR incorporates multiple time periods and multiple cash flows.

IRR and NPV are related metrics: IRR is a specific instance of the NPV calculation. Specifically, IRR identifies the discount rate that makes the net present value of cash flows equal to zero.

Cat: Where are you going?

Alice: Which way should I go?

Cat: That depends on where you are going.

Alice: I don’t know.

Cat: Then it doesn’t matter which way you go.

~Lewis Carroll, Alice in Wonderland

IRR: Primary Dealers Should Emulate Private Equity

The probability of success is increased by choosing the optimal objective, and this immutable law applies to the manufacturing of credit. Primary dealers should emulate private equity: primary dealers should adopt IRR as their performance metric.

IRR is a measure of total return: IRR measures performance in private equity, since IRR provides a comprehensive measure of performance.

In private equity, the IRR target is an independent variable, since the portfolio leverage is generally 0%. With portfolio leverage, the IRR target should still be numerically stipulated; however, the IRR target shifts from an independent variable to a dependent variable. With portfolio leverage, the IRR target should be a modest premium (i.e. 300-500bps) over a benchmark rate (i.e. Fed funds rate).